What You'll Learn

By the end of this tutorial, you'll know how to:

- Find traders with 90%+ win rates in under 2 minutes

- Read real-time trading signals on a price chart

- Decide which trades to copy (and which to skip)

- Execute trades manually, with Discord notifications, or fully automated

- Do all of this on Layer 2 for 1-2 cent gas fees

No coding required for the basic setup. We'll walk through beginner-friendly options first, then show you how to level up with automation if you want it.

Step 1: Find a Traders Worth Copying (2 minutes)

Let's cut to the chase. You want to copy traders that actually make money consistently. Here's how to find them.

Open the AlphaNetworks Dashboard

Head to the traders rankings page. You'll see a list of 1,900+ Ethereum traders, sorted by performance.

What to Look For (The 4 Key Metrics)

1. Win Rate: 85% or higher

This means they win 85+ out of 100 trades. Anything above 90% is exceptional. Below 70%? Skip it.

2. ROI: 30% or higher

Return on Investment over the tracking period. If they turned $10,000 into $13,000, that's 30% ROI. The best traders we track are at 60-120% ROI.

3. Total Trades: 20+ trades minimum

A traders with 5 wins could be luck. A traders with 50 wins? That's a pattern. More trades = more reliable data.

4. Recent Activity: Active in the last 7 days

If they haven't traded in 3 weeks, they might be done. You want traders that are actively trading right now.

✅ Quick Filter Trick

Use the dashboard filters: Set Win Rate > 85%, ROI > 30%, Min Trades > 20. Hit apply. Now you're only looking at proven performers. Pick any traders from that list and you're starting with an edge.

Step 2: Watch Their Trades on the Chart (3 minutes)

Okay, you found a traders with a 92% win rate and 68% ROI. Now what?

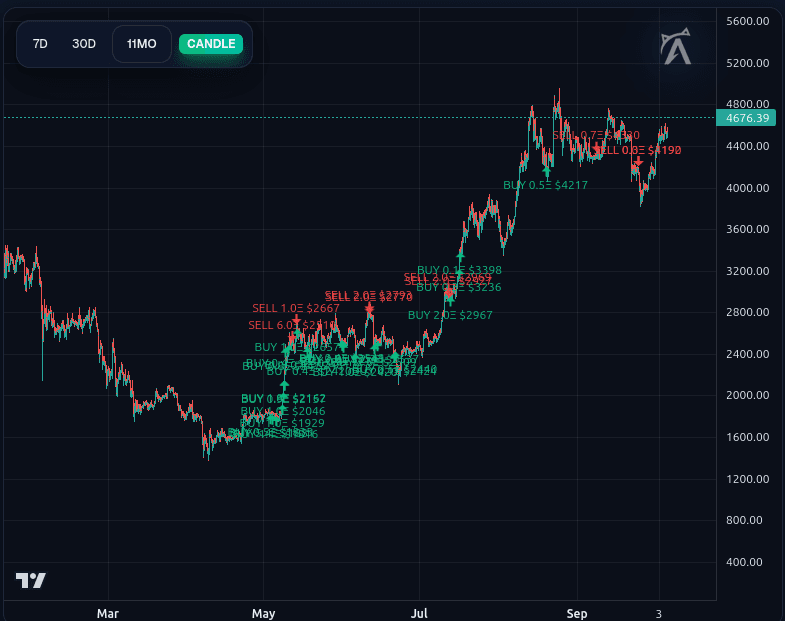

Click into their profile. You'll see a price chart with green "BUY" and red "SELL" signals overlaid on the actual price action.

Example: Real signals from a tracked traders

How to Read the Signals

Green = BUY

When you see a green label on the chart, that's when this traders bought. The label shows the price they paid and the size of their position (as a % of their ETH balance).

Red = SELL

Red labels show when they exited. Compare the buy price to the sell price—that's their profit (or loss) on that trade.

What Good Signals Look Like

- • Buying dips: They enter when price pulls back, not when it's pumping

- • Selling into strength: They exit near local tops, not panic selling into dumps

- • Clean patterns: Most of their buys are followed by sells higher up on the chart

- • Position sizing consistency: They're not suddenly going all-in after a loss (no revenge trading)

⚠️ Red Flags to Avoid

If you see any of these patterns, skip the traders:

- • Multiple buys without sells (they're bagholding)

- • Buying tops and selling bottoms (they're chasing FOMO)

- • Erratic position sizing (10% one trade, 80% the next)

- • No recent trades (they stopped trading or got wrecked)

Step 3: Choose Your Execution Method (5 minutes to set up)

You found a great traders. You understand their signals. Now you need to decide how you'll copy their trades.

Here are three options, ranked from easiest (beginner) to most advanced (full automation):

Option 1: Manual (Watch the Dashboard)

Best for: Beginners who want to learn without automation

Keep the AlphaNetworks dashboard open. When your traders makes a trade, you'll see it appear on the chart in real-time. Then you manually execute the same trade on Uniswap, 1inch, or your preferred DEX.

✅ Pros:

- • Simple—no setup required

- • Full control over every trade

- • Learn by doing

- • No API keys or bots needed

❌ Cons:

- • You need to be watching constantly (almost like a full-time job)

- • Manual execution = slower fills, more slippage

- • Easy to miss trades if you step away

Option 2: Discord Notifications (API + Alerts)

Best for: People who want alerts but still execute manually

Use the AlphaNetworks API to send trade alerts directly to your Discord or Telegram. When your traders trades, you get a ping on your phone. You review it and execute if you like the setup.

Setup (5 minutes):

- Get your API key from AlphaNetworks dashboard

- Set up a Discord webhook (Google "how to create Discord webhook")

- Use our API to subscribe to traders signals

- Signals get posted to your private Discord channel

✅ Pros:

- • Instant notifications on your phone

- • Don't need to watch the dashboard 24/7

- • Still in full control of execution

- • Works while you're doing other things

❌ Cons:

- • Still requires manual execution (slower than bots)

- • Basic API knowledge helpful (but not required)

Option 3: Full Automation (API + Execution Bot)

Best for: Experienced traders who want hands-off copy trading

Connect the AlphaNetworks API to your own execution script. When a signal comes in, your bot automatically executes the trade through your MetaMask traders (or any Web3 traders). Fully automated.

How It Works:

- API sends trade signal (traders bought X token at Y price)

- Your script receives the signal

- Script checks your filters (position size, liquidity, etc.)

- If it passes, script sends transaction to DEX via your traders

- Trade executes in seconds

✅ Pros:

- • Completely hands-off (runs 24/7)

- • Fastest execution (minimal slippage)

- • No need to watch charts or Discord

- • Can copy multiple traders simultaneously

- • Works on Layer 2 for 1-2 cent gas fees

❌ Cons:

- • Requires coding knowledge (or hiring a dev)

- • Need to manage traders keys securely

- • Higher risk if something breaks

💡 Pro Tip: Start with Option 1 or 2

If you're new to copy trading, start manually or with Discord notifications. Get a feel for the traders's behavior. Once you're confident, level up to automation. Don't jump straight to bots if you don't understand what you're copying.

Why You Should Use Layer 2 (Arbitrum, Base, Optimism)

If you're executing trades on Ethereum mainnet (Layer 1), you're paying $10-50 in gas fees per trade. That adds up fast.

Layer 2 networks like Arbitrum, Base, and Optimism run on top of Ethereum but cost 1-2 cents per transaction. Same security, 99% cheaper fees.

❌ Ethereum L1

- • Gas: $15-50 per trade

- • 10 trades = $150-500 in fees

- • Eats into profits quickly

- • Slower during network congestion

✅ Layer 2 (Arbitrum, Base)

- • Gas: $0.01-0.05 per trade

- • 10 trades = $0.10-0.50 in fees

- • Keeps more profit in your pocket

- • Fast execution (1-2 seconds)

How to Use Layer 2

- Bridge ETH from mainnet to Arbitrum or Base (one-time $5-10 fee)

- Execute all your copy trades on Layer 2

- When you want to exit, bridge back to mainnet or cash out directly on L2

Most DEXs (Uniswap, 1inch, SushiSwap) work on Layer 2. Same interface, way cheaper fees.

Your First Trade (Putting It All Together)

Let's walk through what happens when you copy your first trade.

Your traders buys 5 ETH at $2,150

The signal shows they spent 8% of their ETH balance.

You see the signal on your dashboard (or get a Discord ping)

"BUY 0.08E $2150 - Traders A bought WETH"

You decide if you want to copy

Check: Is this a good entry? Is there liquidity? Does this fit your strategy?

You execute: Buy 8% of your portfolio in WETH

If you have $1,000, you buy $80 worth of WETH. Same percentage, scaled to your size.

Wait for their exit signal

When they sell (at $2,300, for example), you get another alert. You sell and take profit.

Result: You made ~7% profit (minus fees)

They made 7%. You made 7%. That's copy trading.

Common Beginner Mistakes (And How to Avoid Them)

Mistake #1: Copying every single trade

Even great traders have mediocre trades. Use filters. Skip low-conviction entries (tiny position sizes, trades during low liquidity hours, etc.).

Mistake #2: Using your entire portfolio on one trade

If the traders uses 8% of their balance, you use 8% of yours. Don't go all-in just because you like the setup. Discipline beats excitement.

Mistake #3: Not having an exit plan

If the traders sells, you sell. Don't "hold a little longer" hoping for more gains. You're copying them for a reason—trust the system.

Mistake #4: Ignoring gas fees

A $20 profit is great. But if you paid $30 in gas, you lost $10. Use Layer 2. Seriously.

You're Ready to Start

That's it. You now know how to:

- ✅ Find traders with proven track records (85%+ win rate, 30%+ ROI)

- ✅ Read real-time signals on a chart

- ✅ Execute trades manually, with Discord alerts, or fully automated

- ✅ Use Layer 2 to keep fees under 2 cents per trade

- ✅ Avoid the mistakes that kill most copy traders

Next step: Start small. Pick one traders. Watch them for a few days. Copy a couple trades with 5-10% of your portfolio. See how it feels. Learn the rhythm. Then scale up.

Copy trading isn't passive income. It's active learning. But if you follow proven traders and execute with discipline, you're stacking the odds in your favor.

Disclaimer

This is educational content, not financial advice. Copy trading carries serious risk. Past performance doesn't guarantee future results. Only invest what you can afford to lose. Do your own research.

Alpha Networks operates flow-derived execution infrastructure for quantitative research. For institutional inquiries: alphanetworksai@gmail.com